6. Packers and Movers GST Bill?

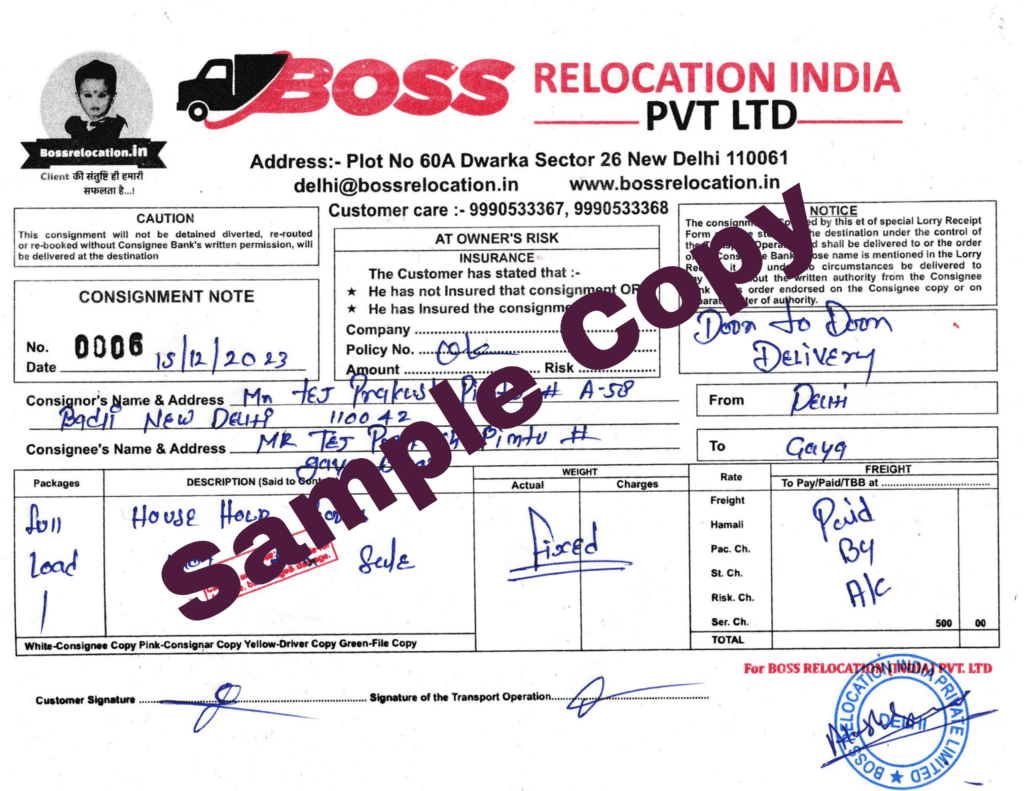

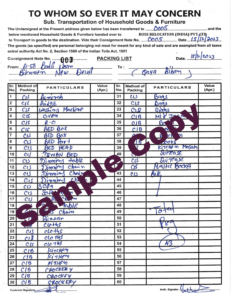

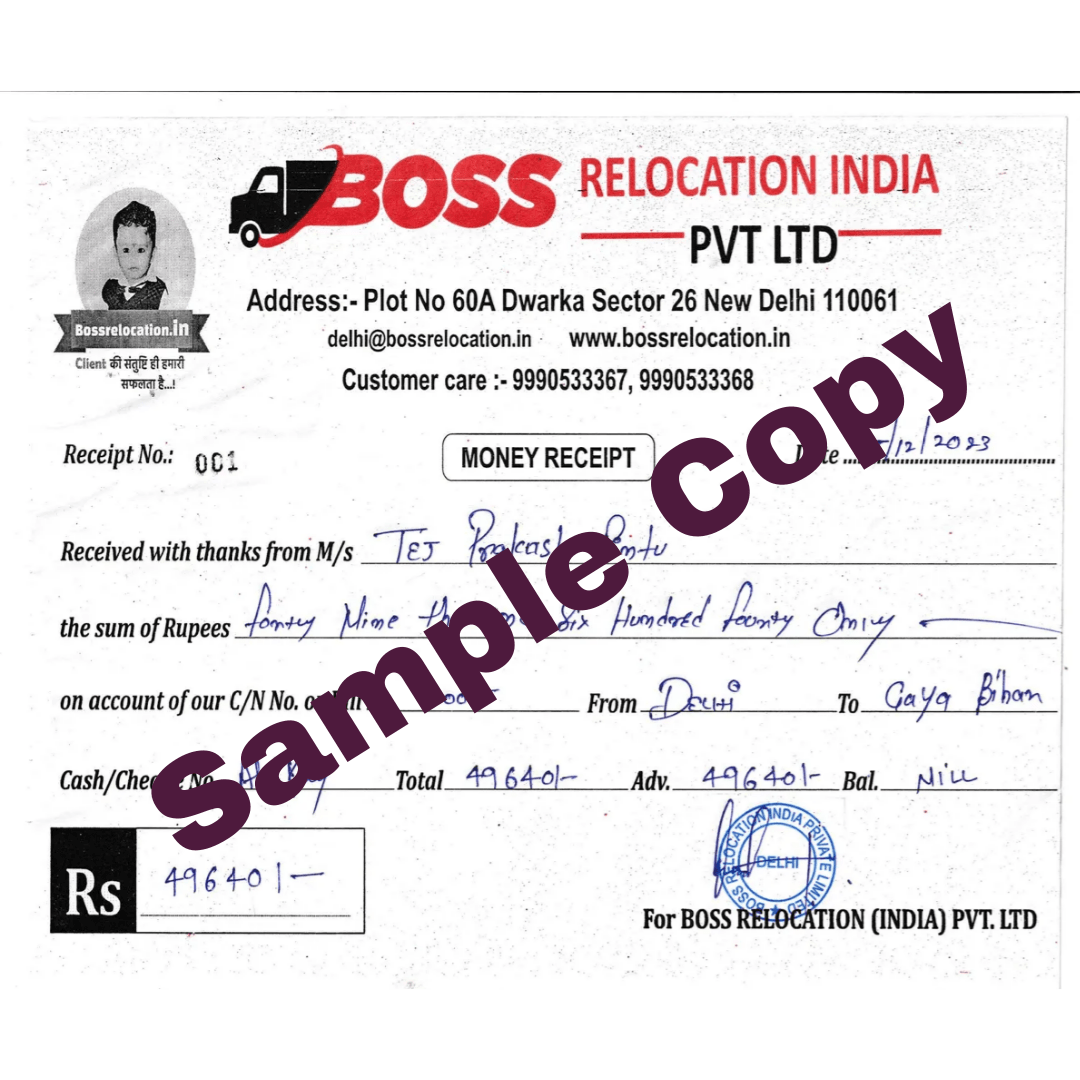

The significance of the Packers and Movers GST invoice is frequently overlooked when moving. Make sure you have the entire set of documentation, including the

GST invoice, payment receipt, and transport bill for household items, in order to take advantage of the benefits of movers and packers GST billing. However, watch

out for fakes and make sure the transport bill is authentic at all times.

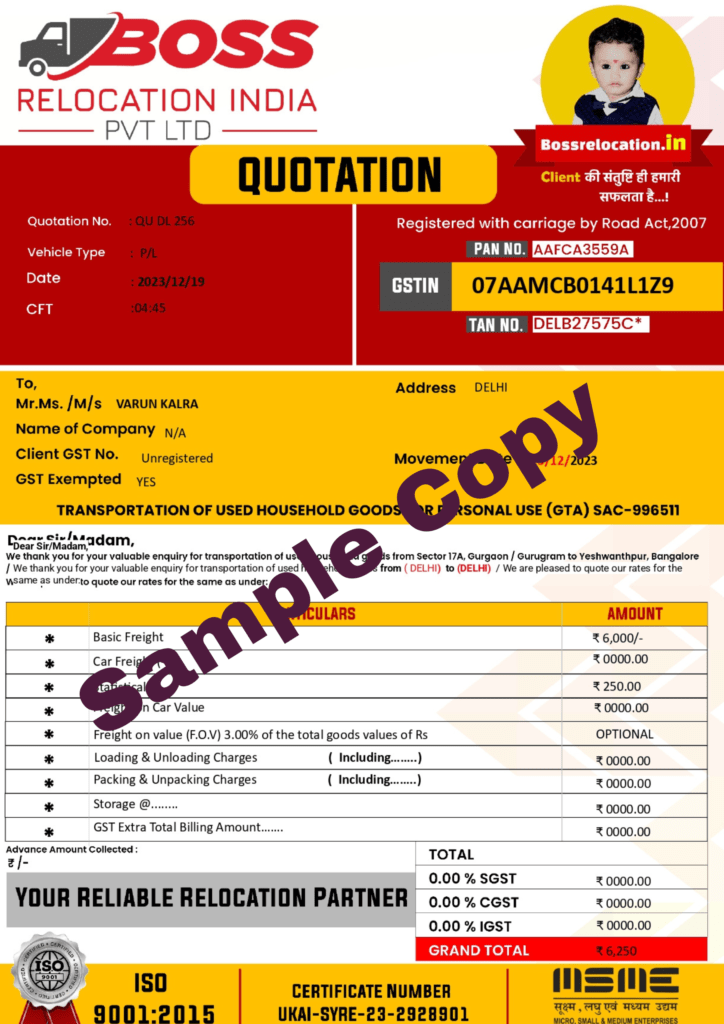

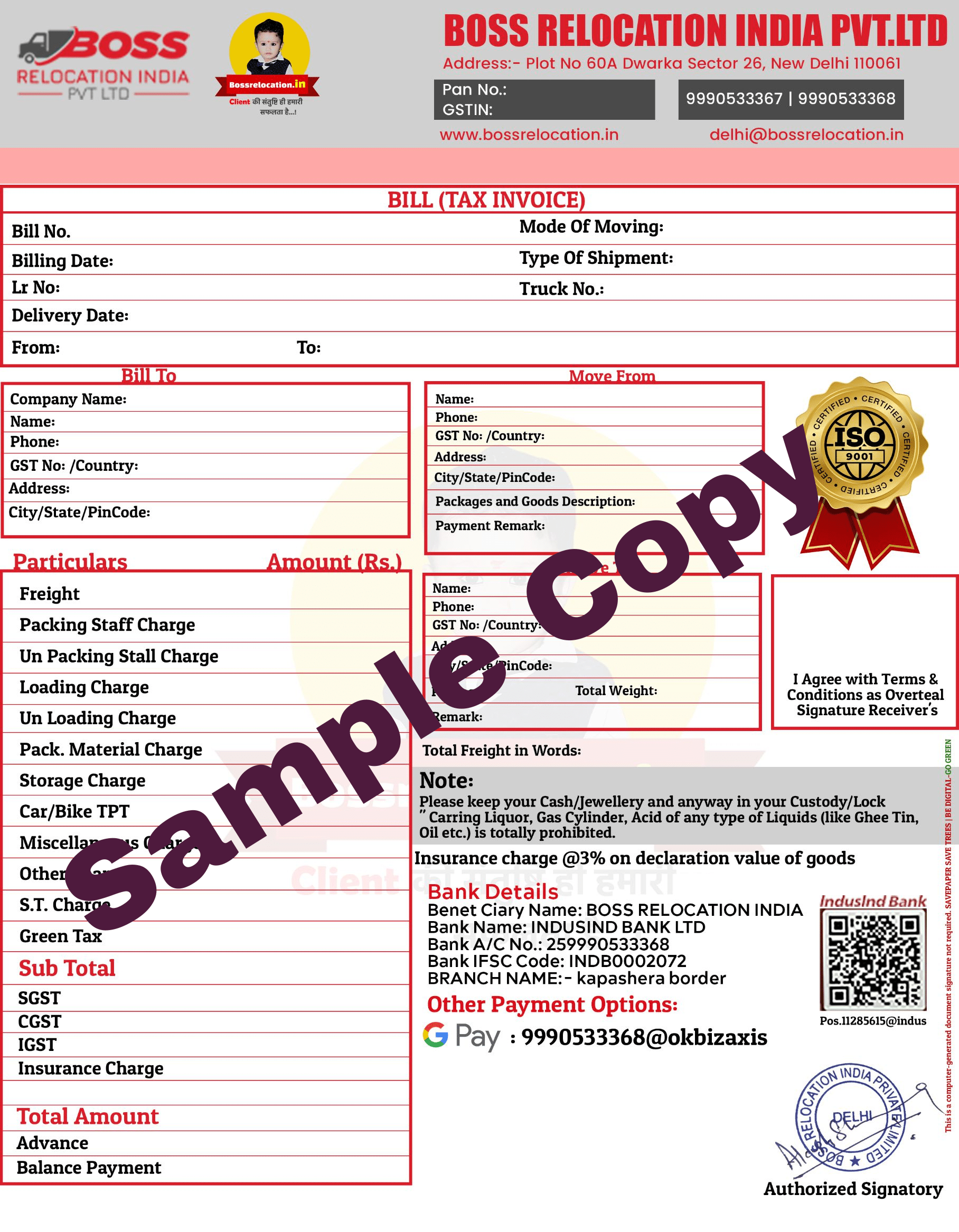

The Packers and Movers GST Bill Format is your lifeline for making your debt claims. You can examine the specific costs associated with each service here.

Authenticity reigns supreme amidst the sea of packers and movers; keep an eye out for bill formats approved by the IBA. Boss Relocation Packers & Movers, a champion

of transparency in their GST Bill Format, is a prime example.

Want Specifics?

Find the Format for the GST Bill for Packers and Movers

Uncover the mysteries:

certain movers levy GST without providing a GST number or explanation. The scene changed on July 1, 2017, when the GST reform was implemented in India. We explore the financial implications for the customers as well as the packers and movers.

On July 1, 2017, the Goods and Services Tax, or GST, was introduced. It has a five-tier structure.

0% – An Overview of the GST Bill for Packers and Movers

At the centre is the Reverse Charge Mechanism. The recipient promises to pay the Indian government directly for GST. If your business is transport services, you will be charged a flat rate of 0% GST as long as you have a GST number.

5% – Examining the GST of Packers and Movers Bill

Imagine a symphony of services including disassembly, packaging, loading, transportation, and unloading. A simple transport trip costs 5% GST. However, services that take on additional hats, such as labour and packaging, become subject to 18% GST.

12% – GST Disclosure for Packers and Movers Bill

We come across the transport alone at 12%. On the other hand, throwing in packing, loading, and unloading for moving houses triggers an 18% GST throughout the process.

18% – GST Bill Decoding for Packers and Movers

An impressive group deserves the 18% spotlight. The entire package, including disassembly and insurance, looks good and pleases the Indian government as well.

28% – Determining the GST Bill for Packers and Movers

The 28% category includes the world of luxury, which includes gold, silver, and expensive clothing. However, as per the GST law, 28% is not applicable to packers and movers.

Your guiding lights—IBA-approved organizations—ensure compliance with Indian government regulations. Here, insurance claims and protection go hand in hand.

GST on Cargo Transport Bill

Cargo transport whisks us into a 5% GST sphere. However, the prevailing misconception of 5% movers and packers GST is clarified – 18% takes the crown.

Boss Relocation Packers & Movers: The Quintessential Blend

This hybrid oasis, bundling labor, transport, and storage, bears an 18% tax burden.

Mix and match services? Proportional calculation ensures fairness.

A 5% voyage with personal packing shifts to 18% when the whole show dazzles with packaging, loading, unloading, and transportation.

Beware, for a 5% GST invoice betrays insurance claims. Opt for the cream of the crop – top-tier packers and movers – to savor a tranquil transition and beyond.